Gen Z Movement Results in Rs. 23.22 Billion in Insurance Claims

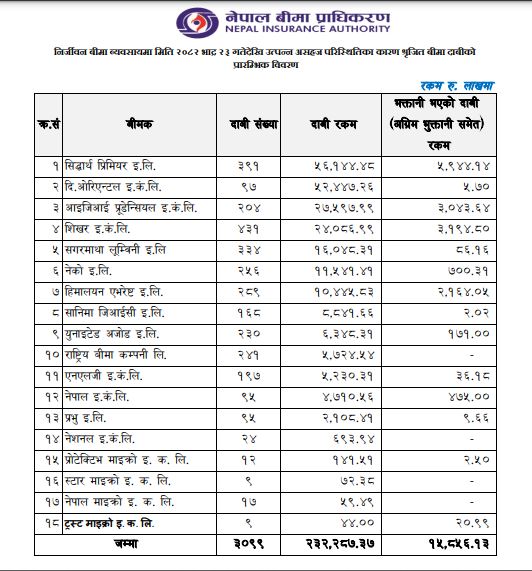

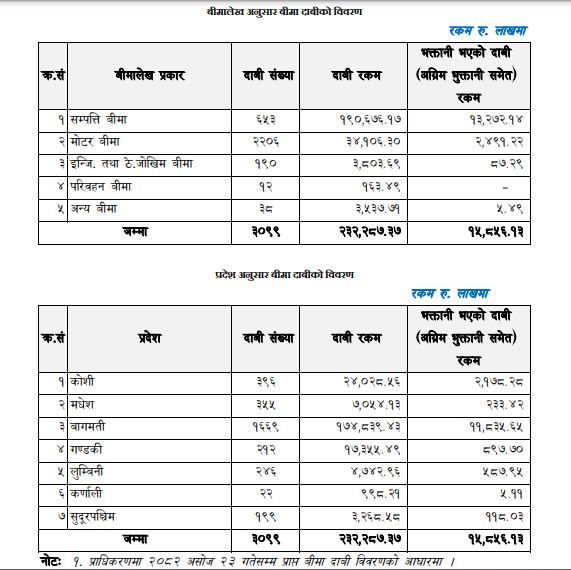

Kathmandu — The aftermath of the recent Gen Z movement has led to substantial insurance claims across Nepal’s non-life insurance sector. According to preliminary data released by the Nepal Insurance Authority (NIA), a total of 3,099 insurance claims amounting to Rs. 23.22 billion have been registered as of October 9. Of this total, insurance companies have already disbursed Rs. 1.58 billion to affected policyholders, including both advance and regular payments.

The surge in claims reflects not only the intensity of the Gen Z protests but also the growing role of insurance as a mechanism for financial protection during social and political unrest. The NIA has been actively coordinating with insurance companies to ensure swift and fair compensation for affected individuals, emphasizing transparency and efficiency in the claims process.

Leading Insurers in Claim Volume

Siddharth Premier Insurance Ltd. reported the highest volume of claims, with 391 claims totaling Rs. 5.61 billion. Of this amount, the company has already disbursed Rs. 594.4 million to policyholders, including advance payments. The large volume of claims reflects Siddhartha Premier’s extensive reach and operational capacity across the country, as well as the company’s ability to respond quickly to high-value claims during crisis events.

Second in line is The Oriental Insurance Company Ltd., which received 97 claims amounting to Rs. 5.24 billion. However, payouts remain limited, with only Rs. 570,000 disbursed as of the reporting date, highlighting a stark contrast in the speed of claims settlement compared to other insurers. The delay has raised questions regarding the operational efficiency and responsiveness of certain insurance companies during large-scale social incidents.

IGI Prudential Insurance Ltd. ranks third, handling 204 claims totaling Rs. 2.76 billion, with Rs. 304.3 million already paid to policyholders. Similarly, Shikhar Insurance Ltd. has received 431 claims valued at Rs. 2.40 billion, disbursing Rs. 319.4 million so far.

Other significant insurers include Sagarmatha Lumbini Insurance Ltd., which processed 334 claims totaling Rs. 1.60 billion, with Rs. 8.6 million disbursed, and Neco Insurance Ltd., with 256 claims amounting to Rs. 1.15 billion, of which Rs. 70 million has been paid. Himalayan Everest Insurance Ltd. also handled 289 claims worth Rs. 1.04 billion, disbursing Rs. 216.4 million to policyholders.

Smaller Insurers and Micro Insurance Companies

Micro and smaller insurers have also participated in processing claims, although the monetary volume is comparatively lower. Sanima GIC Insurance Ltd. disbursed Rs. 200,000, United Ajod Insurance Ltd. paid Rs. 17.1 million, NLG Insurance Ltd. disbursed Rs. 3.6 million, Nepal Insurance Ltd. paid Rs. 47.5 million, and Prabhu Insurance Ltd. disbursed Rs. 900,000. These figures illustrate how smaller insurers are contributing to nationwide relief efforts, particularly for policyholders with lower-value claims.

Analysis of the Claim Process

The preliminary data from the NIA suggests that while high-value claims are concentrated among a few major insurers, there is a wide distribution of claims across different companies. Siddharth Premier’s lead in both the number of claims and payout amount underscores its robust infrastructure and prompt response mechanisms. In contrast, Oriental Insurance’s minimal payouts indicate possible delays in claim verification or processing, a factor that could influence public confidence in certain insurers.

The NIA has emphasized that efficient claims processing is critical for restoring public trust, particularly in the context of politically charged events like the Gen Z movement. The authority has issued instructions to all insurance companies to accelerate claim settlements and has facilitated streamlined procedures for advance payments, ensuring that victims receive timely financial support.

Broader Implications

The Gen Z movement has highlighted vulnerabilities in urban and semi-urban areas where protests and social unrest can result in significant property damage, accidents, and business interruptions. Insurance, in this context, functions as a financial buffer, providing relief and maintaining economic stability for affected citizens.

The preliminary claim data also serves as a performance indicator for insurance companies, revealing which firms can handle high-volume and high-value claims efficiently. Insurers with prompt and transparent claim settlements are likely to strengthen customer loyalty, whereas delays may trigger scrutiny and regulatory intervention.

As Nepal recovers from the disruptions caused by the Gen Z movement, the insurance sector emerges as a critical enabler of resilience. With over Rs. 23 billion in claims registered and Rs. 1.58 billion already disbursed, the sector demonstrates both the challenges and importance of risk management in modern Nepal. The Nepal Insurance Authority’s active role in facilitating claims, combined with the operational readiness of leading insurers, underscores a growing maturity in the country’s non-life insurance market, one that is increasingly responsive to societal and political shocks.